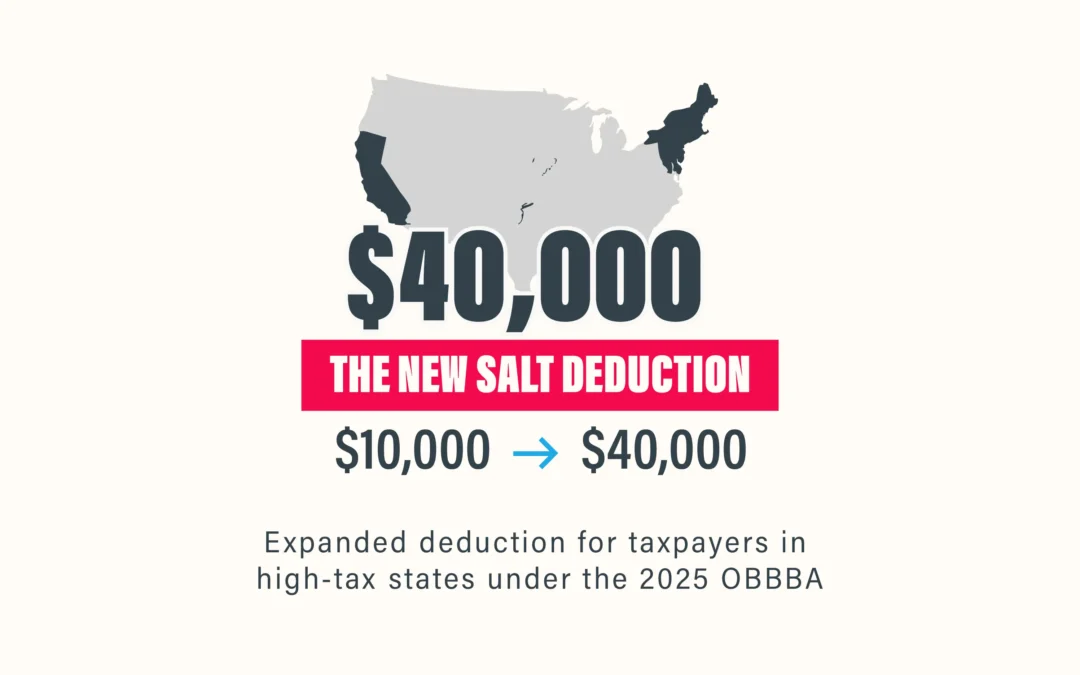

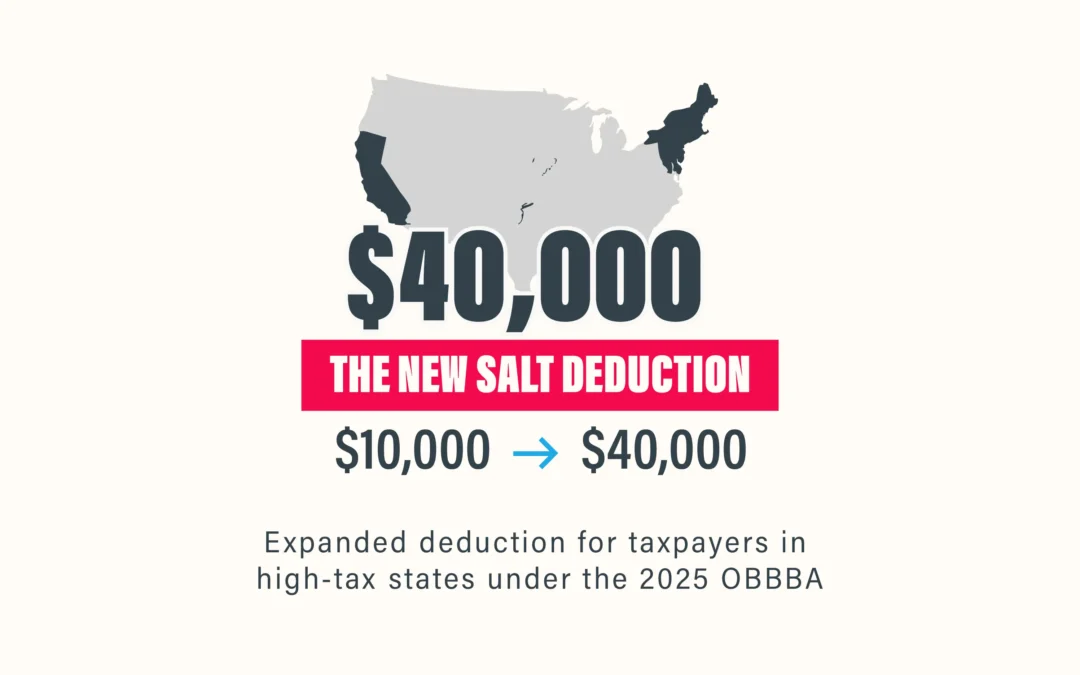

The new $40,000 SALT deduction offers major relief for taxpayers in high-tax states. Learn who benefits and how to plan for savings under the 2025 tax law.

The new $40,000 SALT deduction offers major relief for taxpayers in high-tax states. Learn who benefits and how to plan for savings under the 2025 tax law.

Discover proactive tax strategies for high-income professionals. Learn how CAAS, entity structure, QSBS, and year-round planning reduce tax burdens and build wealth.

This article outlines smart tax reduction strategies for high-income professionals, including how the One Big Beautiful Bill enhances opportunities like QSBS exclusions alongside tools such as retirement plan stacking and 1031 exchanges.

As we approach the March 15th filing deadline for S Corporations and Partnerships, a friendly reminder to accrual basis taxpayers that accrued compensation for bonuses or employer retirement plan contributions for the previous year must be paid by March 15th (or September 15th for retirement plan contributions if the returns are on extension). Failure to pay by this deadline may result in not being able to deduct the expense on the 2022 tax returns and could result in additional tax liability.

No matter where your business is in its life cycle, it’s important to always be thinking ahead and planning for the future. One area where this is especially true is in financing. Even though you can wait until you actually need financing before exploring all opportunities available, this can be a risky approach. Here are several reasons why it’s a good idea to obtain financing before you need it.

The IRS recently announced January 23rd as the official start to the 2023 tax filing season! With W-2 and 1099 reporting deadlines mostly in the rearview mirror and that information starting to arrive in your mailbox, now is a great time to start accumulating your documentation and other information to prepare for the tax filing deadline.

Real estate investing can be a great way to build wealth over time. Having accurate cost basis data for your property portfolio is important to making informed decisions about buying and selling properties.

On November 1st, Massachusetts Department of Revenue began distributing tax refunds in accordance with Chapter 62F