Cash Flow – Plan Ahead, Stay Informed!

For owners and entrepreneurs, careful business planning is a required skillset that takes repetition and

Evaluating the Health of your Key Relationships and Partners

The strength and potential upside of a business is not just dependent on the internal

March 15th Deadline and Deductibility of Accrued Compensation

As we approach the March 15th filing deadline for S Corporations and Partnerships, a friendly

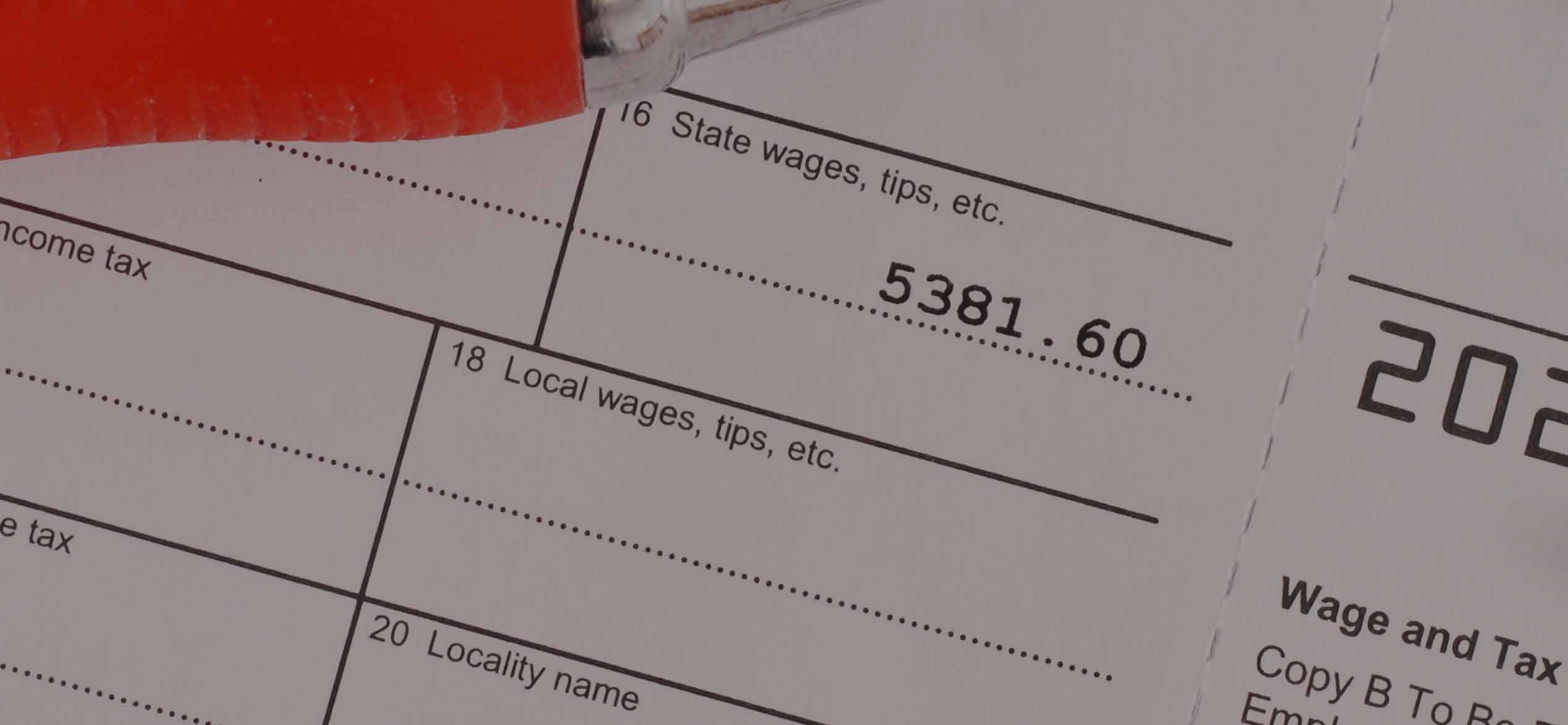

Accountability of your Personal Finances

Building a personal portfolio of valuable assets through hard work and dedication is a truly

Why You Should Obtain Financing Before You Need It

No matter where your business is in its life cycle, it’s important to always be

The Role of a CPA in the Business Sale

Selling a business is a big deal, it's like getting married, you want to make

Getting Ready to File Your Tax Returns

The IRS recently announced January 23rd as the official start to the 2023 tax filing

Streamline and Scale Your Startup: The Benefits of Outsourcing Accounting Services

As an emerging technology startup, you are focused on developing the next disruptive technology and

The Importance of Tracking Cost Basis in Real Estate Investments

Real estate investing can be a great way to build wealth over time. Having accurate

The Benefits of Cloud-Based Accounting Systems

Given the pace at which business is moving in today’s world, it's more important than

Massachusetts Taxpayer Refunds Update

On November 1st, Massachusetts Department of Revenue began distributing tax refunds in accordance with Chapter