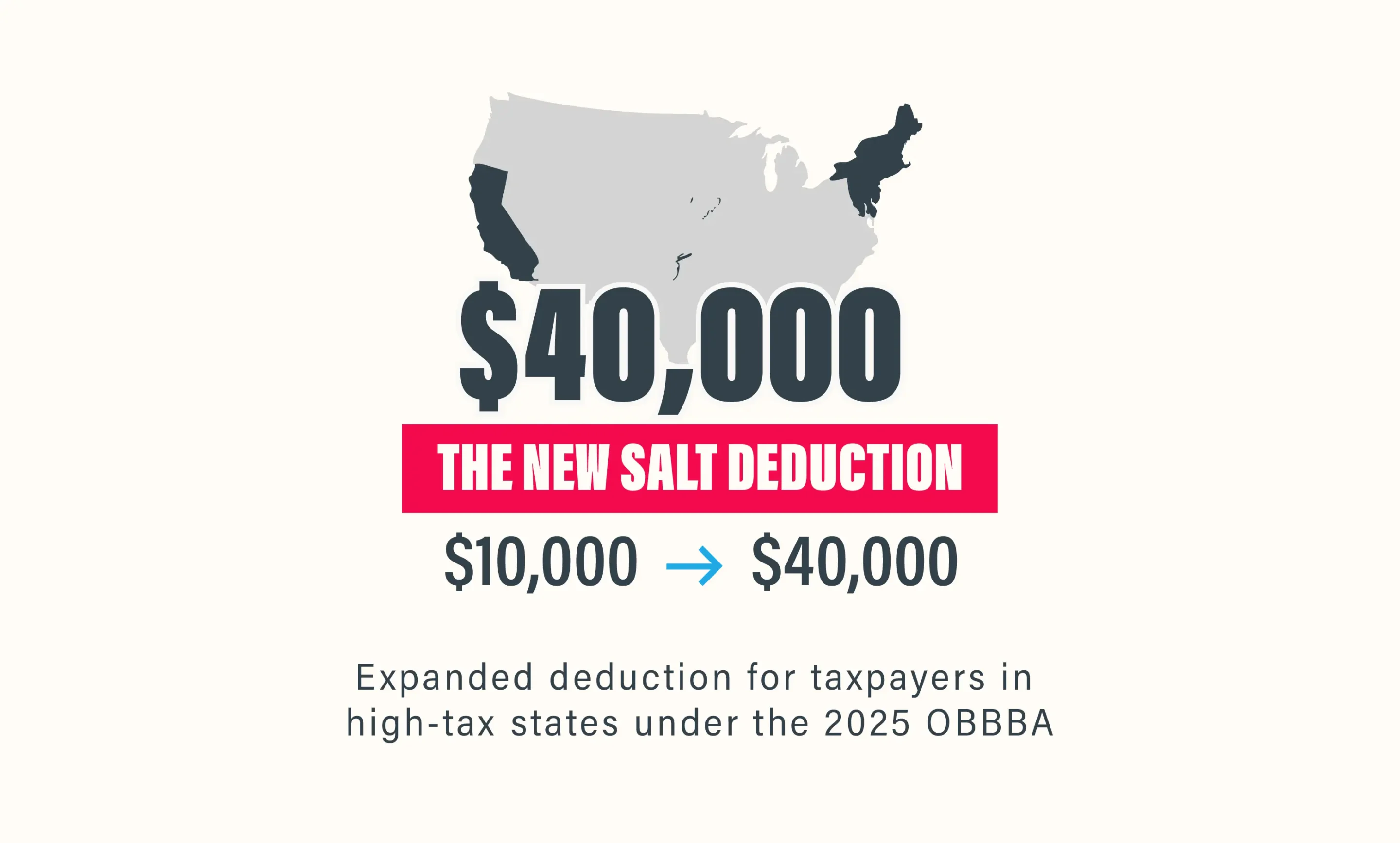

The New $40,000 SALT Deduction: How Taxpayers Can Save on Taxes Under the 2025 Tax Law

Individuals & Families, Privately Owned Businesses

The new $40,000 SALT deduction offers major relief for taxpayers in high-tax states. Learn who...

Read MoreSelling Real Estate? Here’s What You Need to Know About Taxes Before You Close

Individuals & Families, Privately Owned Businesses

Selling real estate can trigger a variety of taxes, from capital gains to depreciation recapture....

Read More1031 Exchanges Explained: How to Defer Taxes on Real Estate Sales

Individuals & Families, Privately Owned Businesses

A 1031 exchange is one of the most powerful tax strategies for real estate investors....

Read MoreThe Fed Just Cut Rates: What It Means for Your Cash, Loans, and Portfolio Over the Next 6 to 12 Months

Individuals & Families, Privately Owned Businesses, Startups and Emerging Technologies

On September 17, 2025, the Federal Reserve cut its benchmark interest rate by 0.25% to...

Read MoreHow High-Income Professionals Can Reduce Their Tax Burden With Proactive Planning

Individuals & Families, Privately Owned Businesses

Discover proactive tax strategies for high-income professionals. Learn how CAAS, entity structure, QSBS, and year-round...

Read MoreTax Reduction Tips for Physicians, Lawyers, and Other High-Income Earners

Individuals & Families, Privately Owned Businesses

This article outlines smart tax reduction strategies for high-income professionals, including how the One Big...

Read MoreHappy Independence Day!

Individuals & Families, Privately Owned Businesses, Startups and Emerging Technologies

As we gather with family and friends this 4th of July to celebrate our nation’s...

Read MoreWhy Your Investment Advisor and CPA Need to Talk The Hidden Cost of Siloed Financial Advice

Discover why siloed financial advice can cost high-net-worth families millions. Learn how integrated planning between...

Read MoreMassive Tax Cuts Coming in 2025? What Business Owners and Investors Need to Know Now

Individuals & Families, Privately Owned Businesses, Startups and Emerging Technologies

Breaking Tax News: A new House budget plan could deliver the biggest tax breaks in...

Read MoreAccountability of your Personal Finances

Building a personal portfolio of valuable assets through hard work and dedication is a truly...

Read MoreGetting Ready to File Your Tax Returns

The IRS recently announced January 23rd as the official start to the 2023 tax filing...

Read More464-2

Individuals & Families, Privately Owned Businesses, Startups and Emerging Technologies

Happy Veteran's Day and thank you to our brave servicemembers!

Read MoreMassachusetts Taxpayer Refunds Update

On November 1st, Massachusetts Department of Revenue began distributing tax refunds in accordance with Chapter...

Read MoreReal Estate Investing – How Material Participation Can Reduce Your Taxes

Real Estate Investing – How Material Participation Can Reduce Your Taxes When done right, real...

Read MoreTo Refund or Rollover – Don’t be a Piggybank

When filing your #taxes, you may end up in a position where your total tax owed...

Read MoreThe Tax Reporting Challenges of Crypto

Cryptocurrencies continue to become more widely accepted as payment for goods and services, and remain...

Read More