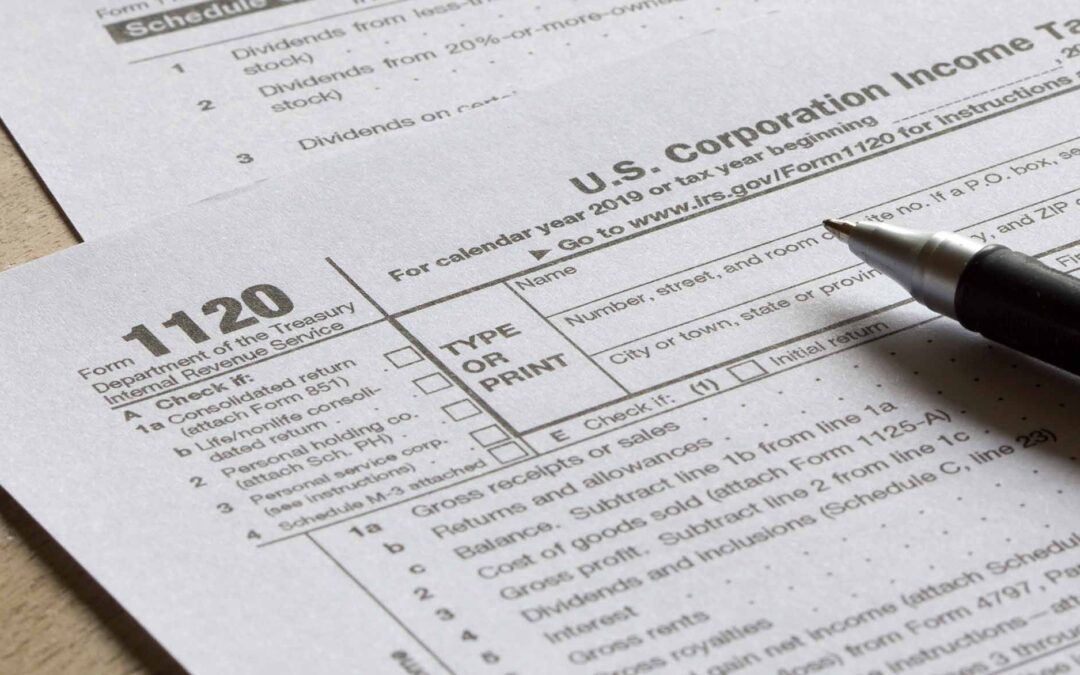

Selling your business is an exciting journey, but one phase can make even seasoned entrepreneurs nervous: due diligence. This is the process where potential buyers scrutinize every aspect of your business, from financial records to customer contracts and operational workflows.