The Hidden Financial Work That Happens Before You Ever Talk to a Buyer

Individuals & Families, Privately Owned Businesses

Buyers evaluate your last three years, not just your growth story. Discover the structured financial...

Read MoreWhy Buyers Don’t Care How Hard You Worked

Buyers don’t pay for effort. They pay for predictable cash flow and reduced risk. Learn...

Read MoreHow a Weaker US Dollar Affects Small Businesses and What You Can Do About It

The dollar is weakening here’s what that means for your pricing, imports, cash flow, and...

Read MoreGold and Silver Prices Are Rising: What Investors Should Know About Taxes, Fees, and How You Hold These Assets

With gold and silver prices reaching new highs, many investors are revisiting positions they may...

Read MoreA Year End Tax Planning Perspective for Business Owners

As the year closes, the right tax planning can protect cash flow and reduce next...

Read MoreA Business Owner’s Guide to Working Capital

Privately Owned Businesses, Startups and Emerging Technologies

Understanding how working capital moves through your business is essential for maintaining cash flow, funding...

Read MoreWhen Profit Isn’t Cash: Understanding the Hidden Gaps in Your Financials

Privately Owned Businesses, Startups and Emerging Technologies

Understanding why profit and cash flow don’t match is essential for business owners. Learn how...

Read MoreHow Banks Evaluate Your Business for a Loan (and How to Make Sure You’re Ready)

Privately Owned Businesses, Startups and Emerging Technologies

When a business owner goes to the bank for financing, it’s not just about having...

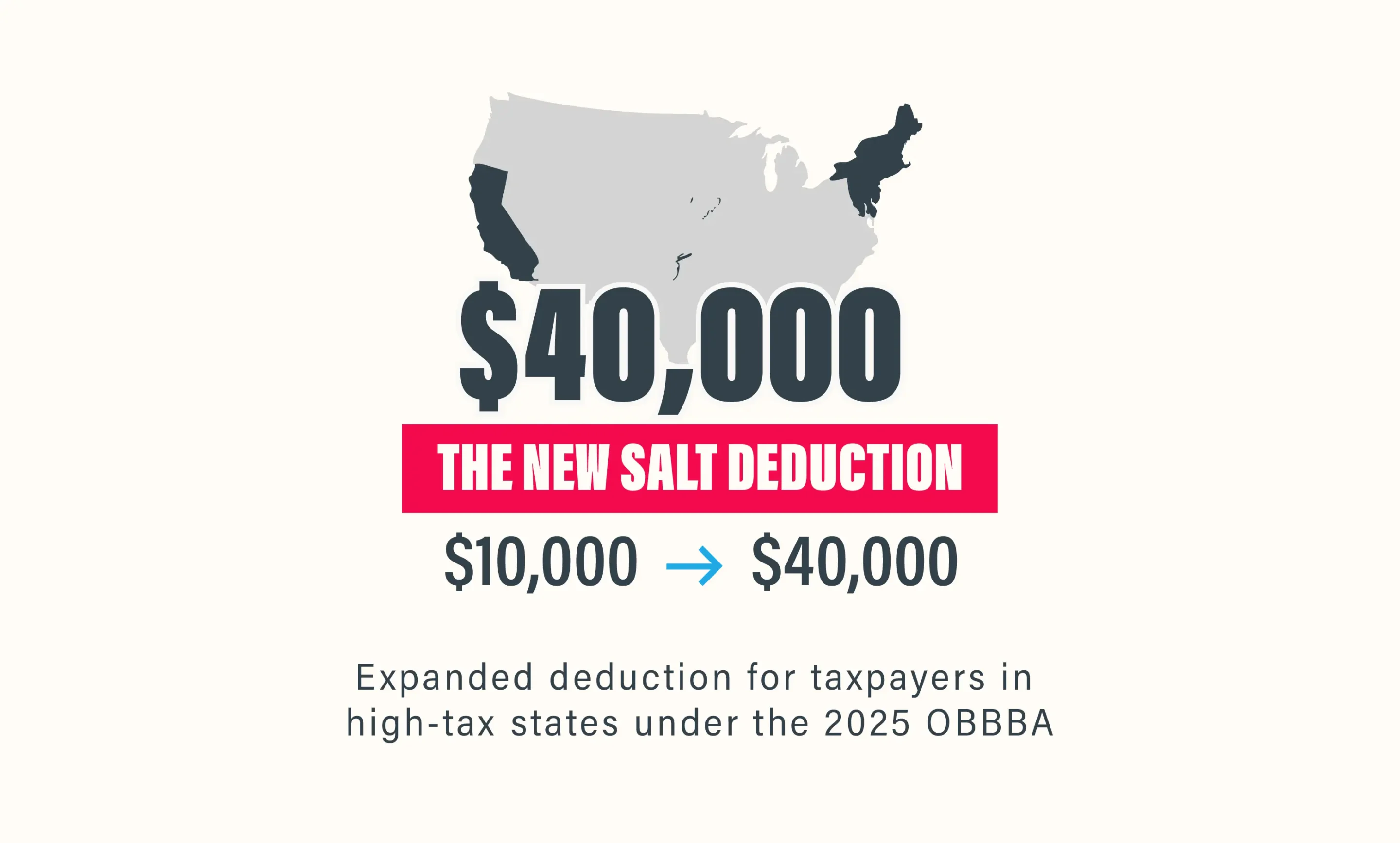

Read MoreThe New $40,000 SALT Deduction: How Taxpayers Can Save on Taxes Under the 2025 Tax Law

Individuals & Families, Privately Owned Businesses

The new $40,000 SALT deduction offers major relief for taxpayers in high-tax states. Learn who...

Read MoreHow to Choose the Right Banker To Help You Sell Your Business

Privately Owned Businesses, Startups and Emerging Technologies

Choosing the right banker or broker is one of the most important steps when selling...

Read MoreSelling Real Estate? Here’s What You Need to Know About Taxes Before You Close

Individuals & Families, Privately Owned Businesses

Selling real estate can trigger a variety of taxes, from capital gains to depreciation recapture....

Read More1031 Exchanges Explained: How to Defer Taxes on Real Estate Sales

Individuals & Families, Privately Owned Businesses

A 1031 exchange is one of the most powerful tax strategies for real estate investors....

Read MoreThe Fed Just Cut Rates: What It Means for Your Cash, Loans, and Portfolio Over the Next 6 to 12 Months

Individuals & Families, Privately Owned Businesses, Startups and Emerging Technologies

On September 17, 2025, the Federal Reserve cut its benchmark interest rate by 0.25% to...

Read MoreA Big Win for Business Owners: QBI Deduction Permanently Extended Under the One Big Beautiful Bill Act

Privately Owned Businesses, Startups and Emerging Technologies

The QBI deduction is now permanent under the One Big Beautiful Bill Act. Learn what’s...

Read MoreUnlock Tax Savings: How the One Big Beautiful Bill Act Restores Full R&D Expensing and Refund Opportunities

Privately Owned Businesses, Startups and Emerging Technologies

Unlock full R&D expensing with the One Big Beautiful Bill Act. Learn how to amend...

Read MoreHow High-Income Professionals Can Reduce Their Tax Burden With Proactive Planning

Individuals & Families, Privately Owned Businesses

Discover proactive tax strategies for high-income professionals. Learn how CAAS, entity structure, QSBS, and year-round...

Read MoreTax Reduction Tips for Physicians, Lawyers, and Other High-Income Earners

Individuals & Families, Privately Owned Businesses

This article outlines smart tax reduction strategies for high-income professionals, including how the One Big...

Read MoreHappy Independence Day!

Individuals & Families, Privately Owned Businesses, Startups and Emerging Technologies

As we gather with family and friends this 4th of July to celebrate our nation’s...

Read MoreRelocating? How to Avoid the Multi-State Tax Trap That Costs Business Owners Thousands

Thinking of relocating your business? Learn how to avoid the multi-state tax trap that can...

Read More4 Tips for Navigating Earn-Outs in a Business Sale

Privately Owned Businesses, Startups and Emerging Technologies

Discover 4 essential tips for navigating earn-outs in a business sale. Learn how to structure...

Read More5 Ways to Pay Less Taxes When Selling Your Business

Privately Owned Businesses, Startups and Emerging Technologies

Learn five tax-saving strategies to reduce your tax liability when selling your business. Discover how...

Read MoreExecutive Order Impact: Key Concerns for Small Business DoD Contractors

President Trump signed a new executive order on February 26, 2025, implementing significant reforms to...

Read MoreMassive Tax Cuts Coming in 2025? What Business Owners and Investors Need to Know Now

Individuals & Families, Privately Owned Businesses, Startups and Emerging Technologies

Breaking Tax News: A new House budget plan could deliver the biggest tax breaks in...

Read MoreThe 6 Types of Buyers You Need to Know Before Selling Your Business

Privately Owned Businesses, Startups and Emerging Technologies

One of the most critical factors in achieving a successful sale is understanding who your...

Read MoreHow to Survive Due Diligence Without Breaking a Sweat

Privately Owned Businesses, Startups and Emerging Technologies

Selling your business is an exciting journey, but there’s one phase that can make even...

Read MoreBecome an Expert in Business Valuation in Less Than 10 Minutes

Privately Owned Businesses, Startups and Emerging Technologies

Selling your business is one of the most significant financial transactions of your life. Whether...

Read MoreCash Flow – Plan Ahead, Stay Informed!

Privately Owned Businesses, Startups and Emerging Technologies

For owners and entrepreneurs, careful business planning is a required skillset that takes repetition and...

Read MoreMarch 15th Deadline and Deductibility of Accrued Compensation

As we approach the March 15th filing deadline for S Corporations and Partnerships, a friendly...

Read MoreThe Role of a CPA in the Business Sale

Privately Owned Businesses, Startups and Emerging Technologies

Selling a business is a big deal, it's like getting married, you want to make...

Read MoreThe Importance of Tracking Cost Basis in Real Estate Investments

Real estate investing can be a great way to build wealth over time. Having accurate...

Read MoreThe Benefits of Cloud-Based Accounting Systems

Privately Owned Businesses, Startups and Emerging Technologies

Given the pace at which business is moving in today’s world, it's more important than...

Read More464-2

Individuals & Families, Privately Owned Businesses, Startups and Emerging Technologies

Happy Veteran's Day and thank you to our brave servicemembers!

Read MoreCash and Accrual Accounting – Which is right for you?

Privately Owned Businesses, Startups and Emerging Technologies

You may be surprised to learn that the language of accounting is diverse for small...

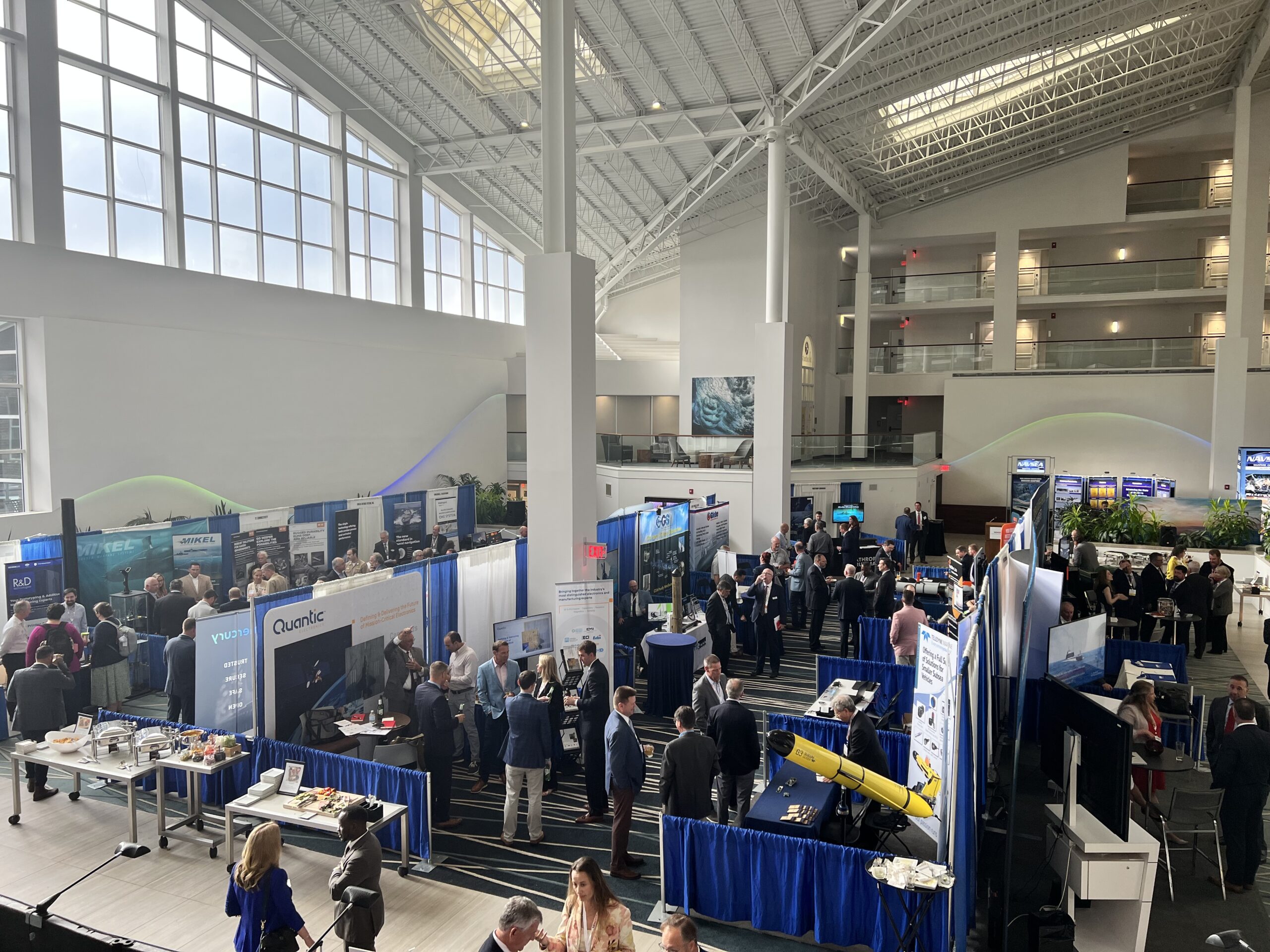

Read More2022 Defense Innovation Days

Privately Owned Businesses, Startups and Emerging Technologies

We are proud to be part of the 2022 Defense Innovation Days conference in Newport,...

Read MoreProtect Yourself from Unpredictable Supply Chain

Global supply chain is rapidly changing - it is a very unusual time in history,...

Read MoreHow is inflation impacting my business valuation? 3 Considerations for Business Owners

This year the U.S. is experiencing record-high inflation due to several significant global economic and...

Read More